Featured Galleries CLICK HERE to View the Video Presentation of the Opening of the "Holodomor Through the Eyes of Ukrainian Artists" Exhibition in Wash, D.C. Nov-Dec 2021

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

Ten USUBC Historic Full Page Ads in the Kyiv Post

Ten USUBC Historic Full Page Ads in the Kyiv Post

COVID-19 tax/legal considerations for clients with connection to Poland/EU, Russia, Ukraine, UK & US

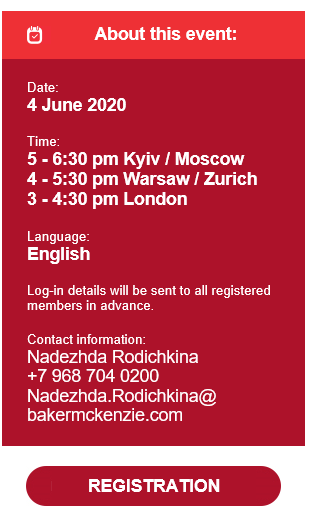

COVID-19 tax/legal considerations for clients with connection to Poland/EU, Russia, Ukraine, UK & US, June 4, 18:30 Kyiv.

COVID-19 tax/legal considerations for clients with connection to Poland/EU, Russia, Ukraine, UK & US, June 4, 18:30 Kyiv.

Join our panel of EMEA experts to identify how COVID-19 will impact your clients from a tax and legal perspective.

For each country (Poland /EU, Russia, Ukraine, UK and US) we will discuss:

- the position of each jurisdiction’s domestic tax authorities,

- what measures might soften potential negative tax exposures,

- what planning measures should be taken into account to:

- develop a position/defense file for using tax treaty benefits, if any,

- consider changes to holding/management structures of family assets, and

- implement other relevant strategies.

The webinar will be of interest to private bankers, trustees, family offices, asset/wealth managers and private clients.

Speakers:

|

Lyubomir Georgiev |

Hennadiy Voytsitskyi |

Piotr Wysocki |

Sergei Zhestkov |

|

|

|

|

|

|

Jacopo Crivellaro |

Artem Toropov |

Phyllis Townsend |

Ida Varshavsky |